To open an Exness live account, visit the Exness website, click on Open Account, select your country of residence, enter your email address, create a password, and submit. Proceed to the membership area on the subsequent page, choose "open trading account," finish the registration process, and validate your account.

- Exness account requirements and documents

- Exness account types

- Exness account opening guide

- Tips for opening a genuine Exness account

- How to verify my account on Exness?

- Can you use Exness without verification?

- Why you should verify your Exness account?

- Potential reasons why the Exness verification procedure might not succeed

- How To Deposit/Fund Your Account On Exness Broker

-

FAQs

- How do I verify my profile on Exness?

- Do I need to verify my Exness account?

- How long does it take for Exness to verify your account?

- How do I verify my payment account on Exness?

- What do you need to open an Exness account?

- How do I open a real account with Exness?

- How much does it cost to start Exness?

- Which country is Exness registered in?

Exness account requirements and documents

Before you open an Exness live account, you need an active email, an operational phone number, and identity documents, which you need to verify your identity and address. So, it is important that you make these documents available before you start the account creation process.

For your Exness live account verification, the first document you will need is proof of identity (POI), while the other is proof of residence (POR).

Proof of Identity (POI)

-

Passport

-

Driver's license

-

National ID

Every POI document you submit needs to have a picture of the client with their full name, which should match the account holder's name. For any of the POI documents to be considered legitimate, they must be issued by the government.

Proof of Residence (POR)

-

Permanent residence card;

-

Utility bill (electricity, water, gas, Internet, landline telephone)

-

Recent bank statement

-

Local tax bill

The Exness account holder's complete name, address, and issue date must be present in the POR document. Again, the document must be up to 6 months old.

When obtaining these documents to open an Exness account, ensure to confirm the requirements for opening an account with a broker, the countries in which it operates, and the amount of the required initial deposit. To register for an Exness account, you must be in one of the nations where opening an account for excess services is permitted.

For instance, Exness does not accept customers from the following nations: Israel, Iraq, Greenland, Canada, Australia, Mauritius, Seychelles, Mauritius, Mali, etc. Therefore, if you reside in nations where Exness services are prohibited, your attempt to open an Exness live trading account will be unsuccessful.

Keep in mind that there are different minimum deposits, the best Exness accounts are standard, standard cent, pro, zero, and raw. These accounts offer various trading features and tools, which is why they are tailored to specific types of traders. Below is how they compare against each other.

Exness account types

For beginner traders looking to open an Exness accoun, the best Exness accounts are standard, standard cent, pro, zero, and raw. These accounts offer various trading features and tools, which is why they are tailored to specific types of traders. Below is how they compare against each other.

| Accounts | Best for | Minimum deposit | Commission | Spreads |

|---|---|---|---|---|

|

Standard |

Beginner and professional traders |

No minimum deposit |

$0 |

From 0.3 pips |

|

Standard cent |

Beginners |

No minimum deposit |

$0 |

From 0.3 pips |

|

Pro |

Seasoned traders |

$200 |

$0 |

From 0.1 pips |

|

Zero |

Scalpers and high frequency traders |

$200 |

$0.2/lot |

From 0.1 pips |

|

Raw spread |

Experienced traders |

$200 |

Up to $3.50/lot |

From 0.0 pips |

Exness account opening guide

Step 1: Visit the Exness Website exness.com

You can visit the Exness website using your web browser on a computer or mobile device. There is a large "Open Account" or "Sign Up" button on the Exness homepage. To begin the account opening process, click this button.

Step 2: Enter your details

Input your home country, password, and email address. If applicable, enter the partner code to link the account to a partner in the Exness partnership program. After checking the box indicating that you are not a citizen of the United States, click "Continue." On the prompt, choose the account you wish to open.

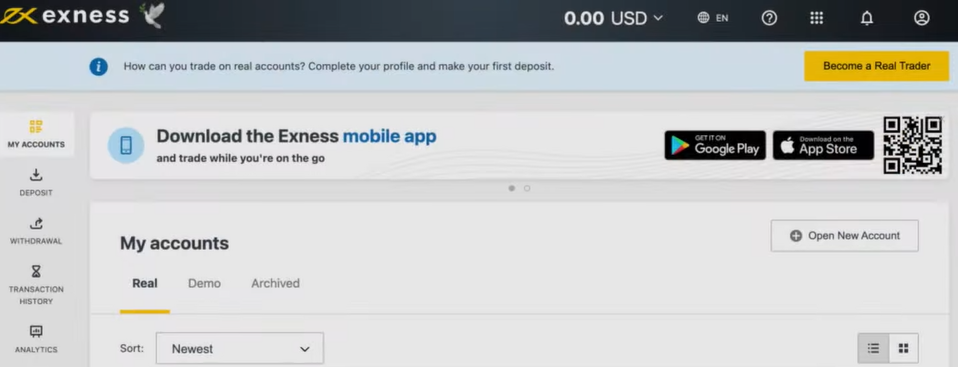

Step 3: Navigate to the membership area and select traders area

Click on open a new account to create an Exness account in your personal area

Step 4: From the list of standard and professional account types, choose the one you wish to open

Step 5: Set up your new Exness trading account

Click on Create an Account to submit your request after choosing the account type, trading platform, maximum leverage, starting balance, currency, changing the account nickname, and creating a password.

Tips for opening a genuine Exness account

Selecting an account type according to your trading style, initial deposit amount, and risk tolerance is essential, and this is one of the best pieces of advice you will find when opening an Exness account. Take care to complete the Exness account verification process to avoid holding up account approval and withdrawal requests. Below are tips for potential traders seeking to open an Exness account.

-

If this is your first time trading, ensure to open and practice with a demo account.

-

To safeguard your account, create a strong, one-of-a-kind password that combines a variety of characters and symbols.

-

To improve your trading knowledge, explore the educational resources on the Exness platform.

How to verify my account on Exness?

Exness verification is straightforward and only demands that the trader use a smart device that is in good working condition. Once more, to prevent needless disruptions and going through a specific step again, ensure your internet connection is strong. So, if you're ready to verify your Exness account, follow the steps below.

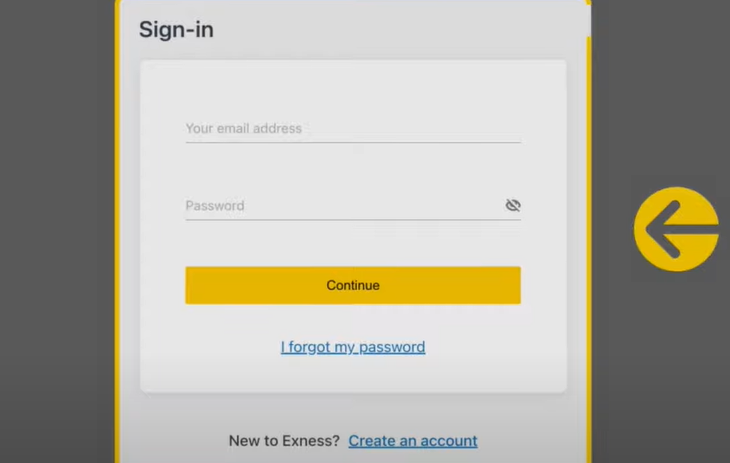

Step 1: Visit the Exness official website and log into your personal area

Step 2: Click on the become a real trader button

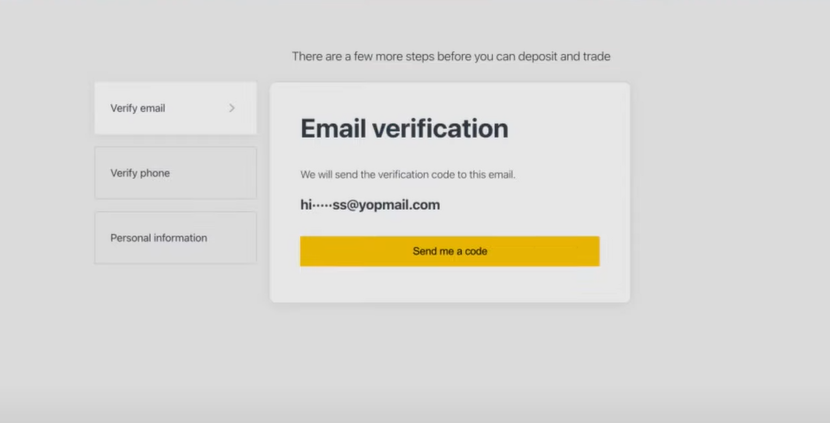

After selecting "Become a real trader," select "send me a code" to confirm your email address at the following prompt. Next, enter the code that was sent to your email in the blank field, and click Proceed.

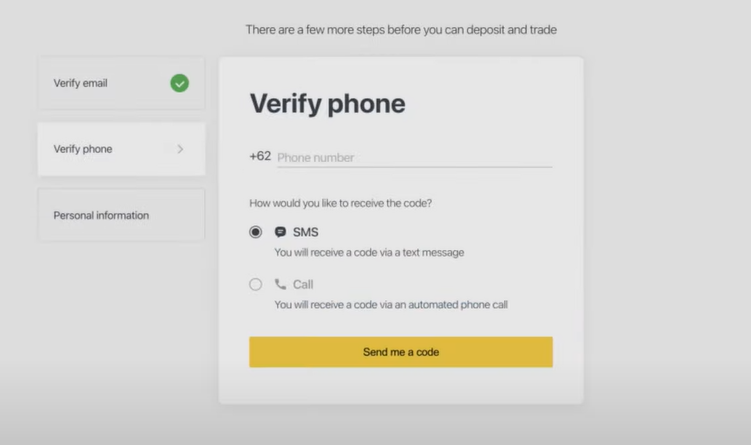

Step 3: Verify your Email and Phone

To verify your phone, select either the call or SMS verification process, then click Send Me a Code. Click Continue after entering the code to finish the phone verification process.

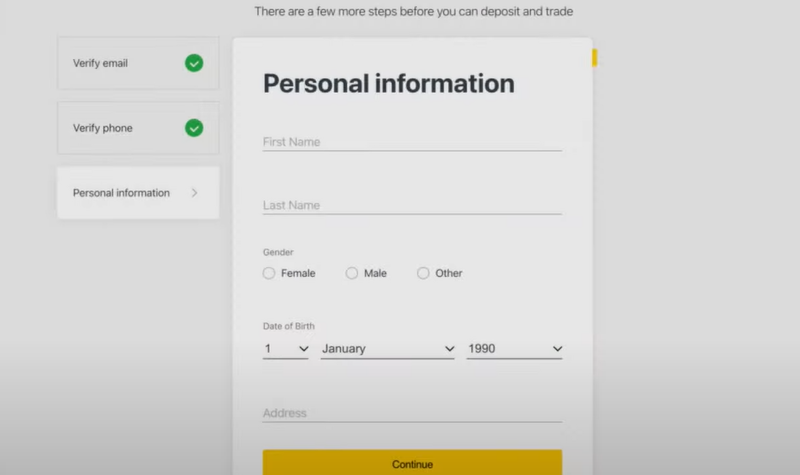

Step 4: Enter your personal information

This stage demands you enter authentic information, as you may have it on your government identity documents. These include your full name, gender, date of birth, and current residential address. Click Continue to confirm this information.

Technically, a message that contains your email, contact number, and personal information is sent to the Exness server for evaluation. Click Continue to complete the economic profile stage.

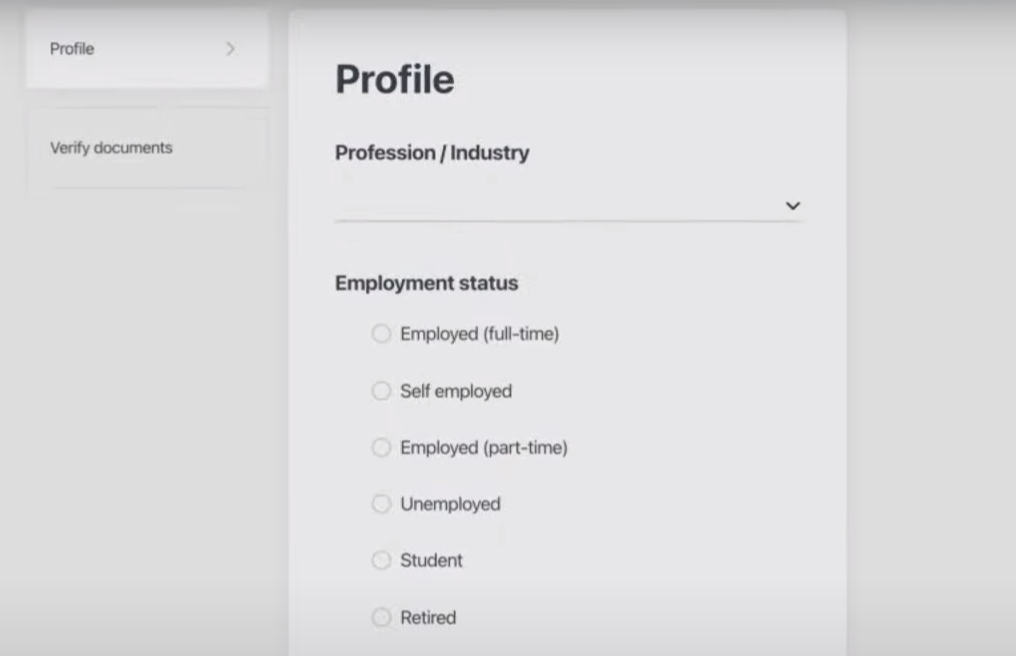

Step 5: Share your trading history on the economic profile with the broker

Here, your choice of answers could be contingent upon your trading background and financial status. After answering all of the broker's questions, click continue to move on to the last step of the Exness verification process.

Image: Exness official website

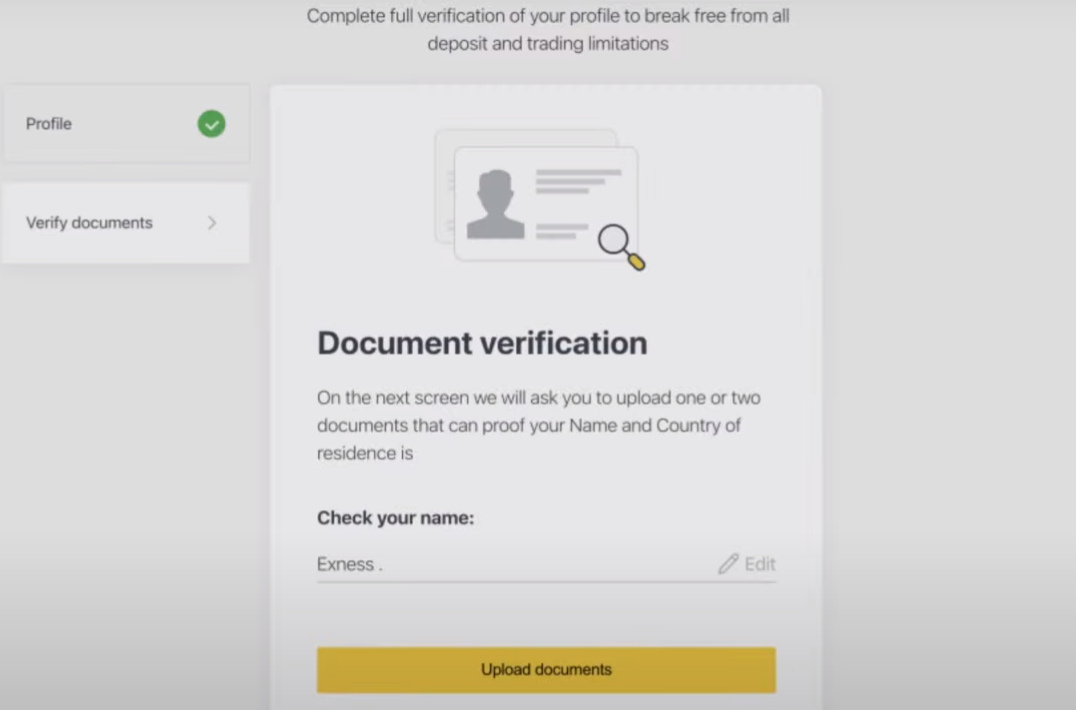

Step 6: Submission of valid identity information

This stage is the most crucial part of the Exness verification. You have to provide valid proof of identity and residence. However, you must first verify your legal name before proceeding, which may need you to upload these documents to the broker. All of your documents, particularly the official and financial ones, must have the same format.

Image: Exness official website

Click the "Upload Document" button to begin the upload process after confirming your legal name.

Choose the nation where the identity document was issued to you.

Select ID type

Capture high-quality images of documents while adhering to the page's dos and don'ts.

Click Upload Document to complete the digital copy attachment process.

Next, select "Submit document."

Step 7: Submit your proof of residence

There are options for the type of document you need to submit in this stage of verifying your Exness account. Click upload after fulfilling the commands.

The success of the Exness verification process depends on the precision of the proof you have submitted. The broker may need to review all of the information and supporting documents you submitted before verifying your account. After 20 to 24 hours, check your PA once more to ensure the success of the Exness account verification. If your verification documents are rejected, you can start the procedure from step 6.

What documents do you need?

Exness verification requires top official documents that tell more about you and your location. Depending on where you live, what kind of account you are opening, and the regulatory authority in your area, different documents and requirements may be needed to verify your Exness account. These include;

Proof of Identity (POI) documents

International passport

National ID card

Driver's license

Voters card

Proof of Address (POA) documents

Utility bill (electricity, gas, landline phone, or water)

Bank statement

Official government document. It should include your name and address and be recent—typically within the last three months.

Documents used for exness verification must be clear, valid, and feature your entire name and photo. Exness typically accepts color scans of documents in high quality, as well as photos and PDFs.

A picture of the client with their full name that corresponds to the account holder's name must be included in the proof of identity (POI) documents. If the document is two-sided, make sure you upload both sides. The client's date of birth must show that they are 18 years of age or older. The client’s full name, address, and issue date must appear on Proof of Residence (POR) documents.

The upload formats for Exness verification documents should be a photo, scanned files, or a photocopy that shows all of the corners. Again, the file extension needs to be one of the following: png, jpg, bmp, mov, webm, m4v, jpeg, mp4, pdf (up to 64 MB).

How long does the Exness verification take?

Verifying an Exness account is quick. If you have legitimate verification documents with you, the process should only take a few minutes to finish. You can anticipate receiving feedback after submitting your Proof of Identity (POI) or Proof of Residence (POR) documents a few minutes after completing the process. However, if the documents need advanced verification (a manual check), it could take up to 24 hours for each submission.

If the email or message you get says Exness account verification is successful, then your Exness account is officially verified. Exness notifies you of the situation and possibly what went wrong if the process fails.

Note:

It is possible to submit the POI and POR documents for both identification processes simultaneously. However, you are free to forego the POR verification phase. Since your address and identity are verified separately, the re-evaluation process may take up to 48 hours if either of the two documents is invalid.

A trader's maximum deposit limit is USD 50,000 if they complete the proof of identity verification process alone. Before restrictions are lifted, the trader must complete the POR account verification.

Can you use Exness without verification?

Yes. Traders can register accounts with Exness and use their services to trade and invest, even without going through the Exness account verification process. While you can use Exness without verification, you might not be allowed to assess the full range of services available on this trading platform. Therefore, traders must finish the verification process to receive the best trading services from Exness.

A trader trading with an unverified account will not be able to withdraw any of their benefits. Any attempt to withdraw funds will require that they verify their account. In addition to adhering to international regulations, Exness verification is in place to guarantee the security and integrity of the platform. It reassures traders that their broker is legitimate, and it also gives the broker peace of mind that each account owner is genuine.

Why you should verify your Exness account?

Verifying your Exness account helps to guarantee that all of your account's activities are legitimate. Brokers use the verification to make sure users on their platform are who they say they are. Once more, it aids the broker in making sure that legitimate account holders follow the financial rules. Below are other top reasons why traders should verify their Exness account.

The first step in ensuring the security of your account and assets is to verify your trading account with Exness. Brokers like Exness can better protect your financial transactions if your account is duly verified.

It could be challenging to get the appropriate authorities to take action if something goes wrong with an unverified trading account. This is why regulators mandate that brokers such as Exness and other financial institutions confirm the identity of their customers. Trading account verification minimizes the risk of nefarious activities, such as money laundering.

Unverified accounts have deposit caps, and some payment options are not available. Since you do not have the flexibility that others using a verified account have, you might be missing out on opportunities to make more profits.

Exness may limit access to certain features and services, like withdrawals, to verified users only. You will miss out on cryptocurrency investments and bank card deposits if your Exness account has not been completely verified. Only verified Exness account users can utilize these features.

Verification assures you that you are trading with a reputable broker.

Note:

If you are unable to verify your account, maybe you can use the few deposit methods for unverified accounts to fund your live account. Exness will issue you a maximum of 30 days to complete account verification.

Again, if you start the process but fail to complete it, you can only be allowed access to fewer services. For example, after completing the economic profile and confirming your phone number and email address, you can deposit a maximum of USD 2,000 per personal area. Upon successful account verification, these restrictions are removed. Verification of Exness is a prerequisite for all Forex traders worldwide using the Exness platform.

Potential reasons why the Exness verification procedure might not succeed

There are several reasons why your Exness account verification may have failed. Here are some possible reasons why you received a message stating that the process failed at the end of the Exness verification.

Verification of an Exness account may fail if a document uploaded is in an unsupported language.

Uploading an identity document that shows the trader is not up to 18 years.

Document proving address without client's name.

You uploaded a low-quality photo and provided comparable documentation for POI and POR verification.

The identity document is no longer valid, or the document photos have been altered.

There is no visibility of the document's corners or document data.

The data in the document is not sufficiently visible for the system to read.

You have 45 days to upload a new document for everyone that was rejected. Exness will notify you of the remaining time by placing a timer at the top of your area. Your Exness account will be blocked, and you will not be able to access the funds if you do not finish the process within the issued days.

How To Deposit/Fund Your Account On Exness Broker

FAQs

How do I verify my profile on Exness?

You will need to follow the platform's verification procedures to validate your Exness profile. These procedures usually entail providing particular documents and information that attest to your identity and compliance with legal requirements. Finding the "become a real trader button" is the first step in the process. Then, follow the instructions to upload identification documents, such as a driver's license, passport, or national ID card. Provide documentation attesting to your residential address as well.

Do I need to verify my Exness account?

Yes. If you want to enjoy all the trading services that Exness offers, then verifying your account is the next step after opening an account. Verifying your trading account will ensure the security of your funds and compliance with regulatory requirements. Also, it will give you the luxury of depositing and withdrawing funds using any payment method you find convenient.

How long does it take for Exness to verify your account?

The least time that Exness can take to verify an account is 24 hours, particularly if the documents need advanced verification (a manual check). However, traders should receive feedback minutes after submitting Proof of Identity (POI) or Proof of Residence (POR) documents.

How do I verify my payment account on Exness?

Log into the main area and click Complete Verification at the top to verify your payment account. Following the on-screen instructions, complete the economic profile verification and upload the required identity and address verification documents. After verification, you can use any accepted payment method to execute transactions.

What do you need to open an Exness account?

You must have a working email account and a phone number to create a new Exness account. Once registered, you must completely verify your Exness account with relevant proof of identity and proof of residence documents to keep it operational.

How do I open a real account with Exness?

First, you need to visit the official website of Exness, click on the open account button, and enter your emails and other personal details to gain access to the personal membership area. While on the membership page, click on open account, then select account type, complete the account settings, verify your account, deposit, and start trading with your account.

How much does it cost to start Exness?

The cost of opening an Exness account depends on the type of account you choose. A standard account does not require any cost, but professional accounts might require a trader to make a minimum deposit of $200 before they can start trading with them.

Which country is Exness registered in?

Limassol, which is a city on the southern coast of Cyprus, is home to Exness, which was established in 2008. With license number 178/12, this broker is approved strictly under the supervision of the Cyprus Securities and Exchange Commission (CySEC). Exness complies with the standards and guidelines set forth by the EU's financial regulators, making them one of the safest investment platforms.